The UAE is playing a pivotal role in what promises to be a transformative phase for the Middle East and Africa (MEA) as these regions navigate plans for an extensive $3 trillion project pipeline from 2026 to 2030. Bolstered by significant real estate and infrastructure investments, the UAE is poised for a concentrated growth burst.

Key Insights from the UAE Real Estate Landscape

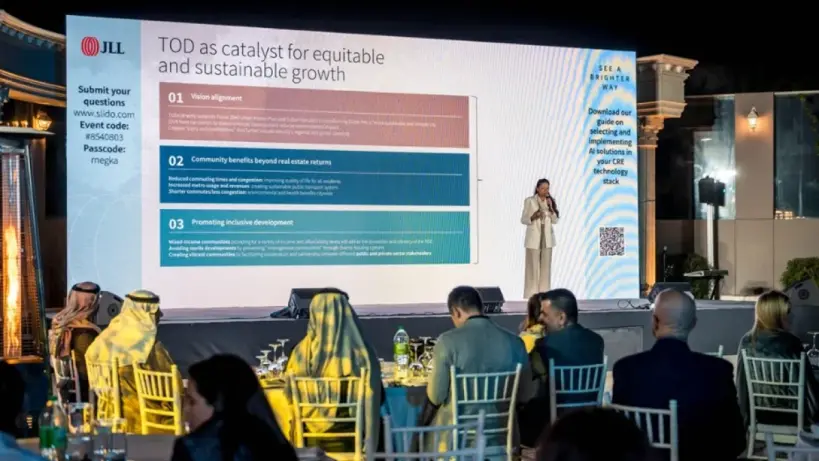

At the recent event held in Dubai titled 'Navigating Tomorrow: Critical Insights for the UAE’s Evolving Real Estate Landscape', James Allan, CEO for UAE, Egypt, and Africa at JLL, highlighted the strong market underpinnings that have been driving growth. In 2025 alone, residential transactions reached new heights, and rent prices for industrial and logistics properties saw double-digit increases. Office space saw unprecedented demands, with a mere 1% vacancy rate, largely driven by skilled professionals relocating to the region and increased investments in infrastructure.

The UAE has committed $470 billion to real estate projects by 2030, with over $300 billion allocated for developments in Dubai. The future is set to see trends like 'flight to quality', with AI-driven data centers being integrated more widely.

Office Space Dynamics in the UAE

In a survey by JLL, a favorable office-centric culture was noted, with most businesses in the UAE, Saudi Arabia, and Qatar planning to expand their office space. As demand for quality and employee-centric workplaces grows, the UAE is experiencing a boom in premium office investments. This boom is supported by government-led economic initiatives and strong growth fundamentals.

Projections show Abu Dhabi's office supply will rise by only 7.9% by 2028, maintaining tight vacancy rates at 0.1% for Prime and 1% for Grade A spaces. Meanwhile, Dubai's office scene is just as constrained, with only a 3.5% increase in supply, resulting in Grade A vacancies of just 3.4%.

Industrial and Logistics Investments

The industrial and logistics sectors are seeing increasing institutional investments, backed by near-full occupancy and robust rental growth. This trend is further energized by the expansion of Al Maktoum International Airport and new economic hubs attracting regional and international capital.

Khalifa Economic Zones Abu Dhabi (KEZAD) is playing a crucial role in expanding industrial developments and nurturing stable rental growth. Meanwhile, the development of Dubai’s Metro Blue Line, with an investment of $5 billion, is anticipated to spur urban growth, offering strong returns on investments.

Transformations in Dubai's Land Market

Dubai's land market has significantly evolved, with transaction values skyrocketing by 786% to $121.4 billion between 2019 and 2025. This surge is propelled by population growth, a robust infrastructure pipeline worth $10.6 billion, and regulatory reforms which have attracted global capital.

Experts emphasize the importance of asset retrofitting and repurposing to adapt to higher land prices and changing occupier preferences. This strategic shift is aimed at ensuring the long-term viability and profitability of assets.

Overall, as the UAE continues to cement its role as a cornerstone in the MEA’s ambitious project pipeline, the region is set for a future where strategic investments and regulatory alignments pave the way for sustained economic prosperity.

Comments

Log in to write a comment