With the expiration of ACA tax credits, many Americans are increasingly opting for high-deductible health insurance plans. This shift could have deadly consequences, particularly for those diagnosed with cancer, as a recent study reveals.

Impact of Rising Deductibles

High-deductible health plans (HDHPs) require patients to cover a substantial portion of their medical costs before insurance kicks in. According to a study published in JAMA Network Open, cancer patients with these plans experience lower survival rates compared to those with traditional insurance. The study highlights the financial burden these plans impose, forcing individuals to make tough choices about their care.

Rising Costs and Difficult Choices

The price of healthcare continues to soar, and Americans face difficult decisions when choosing insurance plans. The situation is particularly pressing in the marketplace for Affordable Care Act (ACA) plans. Recent spikes in premiums, exacerbated by the absence of tax credits, have led to more people selecting high-deductible bronze plans.

Financial Strain on Cancer Patients

The researchers, led by Justin Barnes from Mayo Clinic, investigated how these plans impact cancer patients. The study revealed concerning trends: higher deductibles correlate with decreased likelihood of patients accessing essential medical services. This financial pressure can lead to delays in treatment, skipped medical appointments, and declining survival rates.

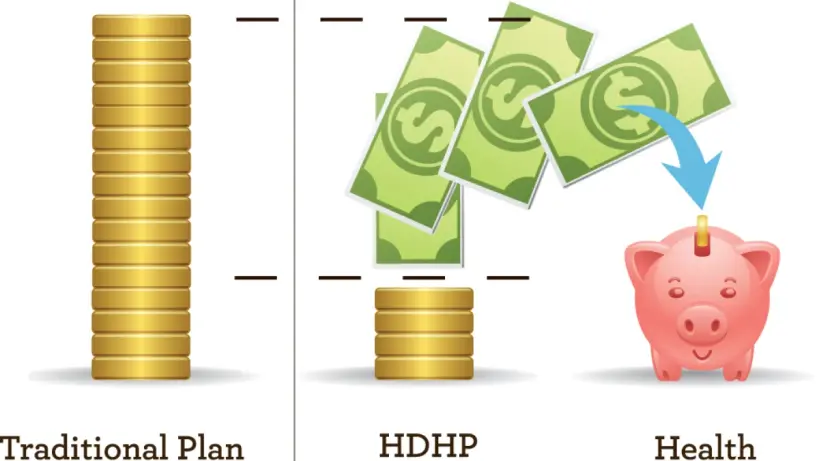

Understanding High-Deductible Plans

In the study, plans were labeled as HDHPs if deductibles were between $1,200 to $1,350 for individuals, or $2,400 to $2,700 for families from 2011 to 2018. For comparison, the average deductible for an ACA bronze plan in 2026 is projected to be around $7,500, as reported by KFF. The significant gap in out-of-pocket expenses underscores the financial challenges faced by patients.

Concluding Thoughts

The findings serve as a sobering reminder of the risks associated with high-deductible plans, especially for those battling severe illnesses like cancer. As healthcare costs rise and the landscape of insurance options evolves, it's crucial for policymakers to consider the broader implications on public health and access to care.

Comments

Log in to write a comment